Our objective right here at Credible Operations, Inc., NMLS Quantity 1681276, known as “Credible” under, is to provide the instruments and confidence you’ll want to enhance your funds. Though we do promote merchandise from our companion lenders who compensate us for our companies, all opinions are our personal.

The most recent non-public scholar mortgage rates of interest from the Credible market, up to date weekly. (iStock)

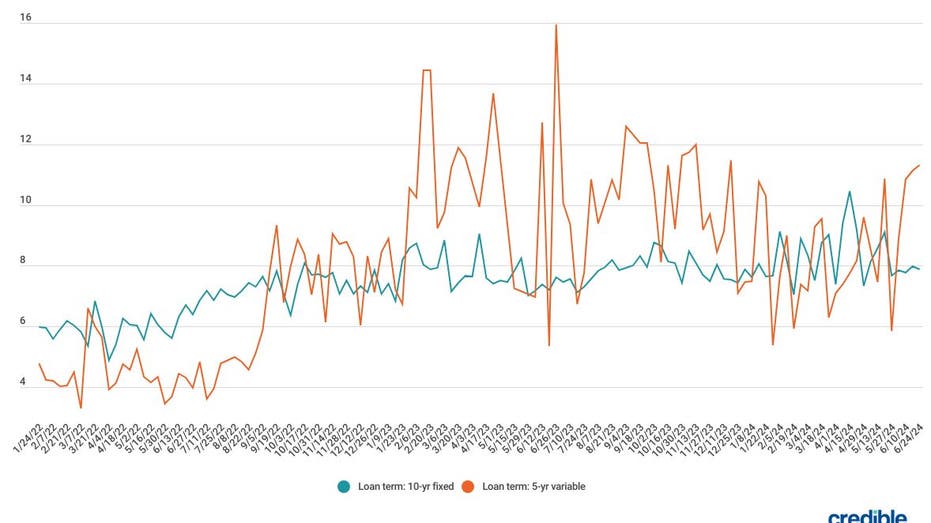

Through the week of June 24, 2024, common private student loan rates decreased for debtors with credit score scores of 720 or increased who used the Credible market to take out 10-year fixed-rate loans, whereas charges elevated for debtors taking out 5-year variable-rate loans.

- 10-year fastened charge: 7.87%, down from 7.97% the week earlier than, -0.10

- 5-year variable charge: 11.31%, up from 11.14% the week earlier than, +0.17

By way of Credible, you possibly can compare private student loan rates from a number of lenders.

For 10-year fastened non-public scholar loans, rates of interest fell by 0.10 proportion factors, whereas 5-year variable scholar mortgage curiosity rose by 0.17 proportion factors.

Debtors with good credit score might discover a decrease charge with a personal scholar mortgage than with some federal loans. For the 2024-25 educational college yr, federal scholar mortgage charges will vary from 6.53% to 9.08%. Personal scholar mortgage charges for debtors with good-to-excellent credit score may be decrease proper now.

As a result of federal loans include sure advantages, like entry to income-driven compensation plans, you need to at all times exhaust federal scholar mortgage choices first earlier than turning to personal scholar loans to cowl any funding gaps. Personal lenders reminiscent of banks, credit score unions, and on-line lenders present non-public scholar loans. You should use non-public loans to pay for schooling prices and dwelling bills, which could not be coated by your federal schooling loans.

Rates of interest and phrases on non-public scholar loans can differ relying in your monetary state of affairs, credit score historical past, and the lender you select.

Check out Credible companion lenders’ charges for debtors who used the Credible market to pick a lender throughout the week of June 24:

Personal scholar mortgage charges (graduate and undergraduate)

Who units federal and personal rates of interest?

Congress units federal scholar mortgage rates of interest annually. These fastened rates of interest rely on the kind of federal mortgage you’re taking out, your dependency standing and your yr in class.

Personal scholar mortgage rates of interest may be fastened or variable and rely in your credit score, compensation time period and different elements. As a normal rule, the higher your credit score rating, the decrease your rate of interest is more likely to be.

You may compare rates from multiple student loan lenders utilizing Credible.

How does scholar mortgage curiosity work?

An rate of interest is a proportion of the mortgage periodically tacked onto your stability — basically the price of borrowing cash. Curiosity is a technique lenders can make cash from loans. Your month-to-month cost usually pays curiosity first, with the remainder going to the quantity you initially borrowed (the principal).

Getting a low rate of interest might enable you get monetary savings over the lifetime of the mortgage and repay your debt sooner.

What’s a fixed- vs. variable-rate mortgage?

Right here’s the distinction between a hard and fast and variable charge:

- With a fastened charge, your month-to-month cost quantity will keep the identical over the course of your mortgage time period.

- With a variable charge, your funds may rise or fall primarily based on altering rates of interest.

Comparability looking for private student loan rates is straightforward while you use Credible.

Calculate your financial savings

Utilizing a student loan interest calculator will enable you estimate your month-to-month funds and the entire quantity you’ll owe over the lifetime of your federal or non-public scholar loans.

When you enter your data, you’ll be capable to see what your estimated month-to-month cost will probably be, the entire you’ll pay in curiosity over the lifetime of the mortgage and the entire quantity you’ll pay again.

About Credible

Credible is a multi-lender market that empowers shoppers to find monetary merchandise which can be the most effective match for his or her distinctive circumstances. Credible’s integrations with main lenders and credit score bureaus enable shoppers to shortly examine correct, customized mortgage choices – with out placing their private data in danger or affecting their credit score rating. The Credible market gives an unmatched buyer expertise, as mirrored by over 7,400 positive Trustpilot reviews and a TrustScore of 4.8/5.